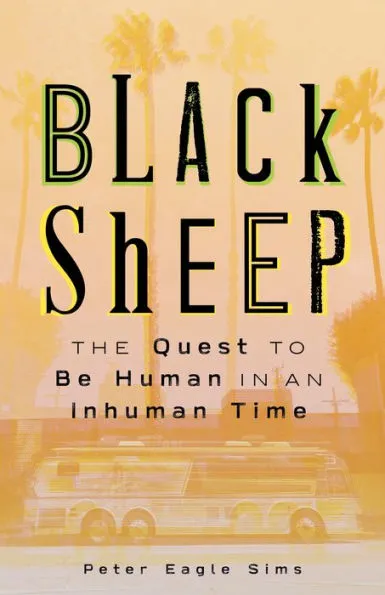

Little Bets got some nice coverage in Forbes today, as the pharma industry wrestles with a culture of BIG bets. The nature of the long cycle times and illusions of rationality in the pharma industry helps to explain why we (the San Francisco BLKSHP) are having such great collaborations with senior execs @ Genentech about helping them to rethink their development and processes. Genentech is making a HUGE difference in the world, yet need help getting away from the overly rational mindsets that block discovery and waste resources — the “illusion of rationality” as per Little Bets: How Breakthrough Ideas Emerge from Small Discoveries.

Is Big Pharma Dangerously Betting on Huge, Fragile Product Shots?

David Shaywitz, Contributor

Historically, the most significant challenge small biotechs faced was whether to advance a relatively broad portfolio of programs or whether to bet the whole enchilada on a so-called “product shot.”

As I’ve discussed in context of Peter Sims’ wonderful book “Little Bets” (reviewed here), there is a classic tension between investors, who typically favor product shots (since they own a portfolio of small biotechs), and company management, who appropriately worry about risking everything on one program.

It’s fascinating to watch how the same challenge appears to be creeping up the food chain, and many big pharmas seem to be investing outlandish amounts of money pursuing similar product shots – Sanofi’s recently announced PCSK9 clinical trial is just the latest example.

While no one is suggesting big pharmas are shunting absolutely all of their R&D resources to mega development programs, these companies could clearly fund a number of smaller development programs with the money they are spending on these huge, individual programs. For all the talk about the age of the blockbuster being over, it’s crystal clear that many big pharmas not only remain fixated on blockbusters but feel confident they can identify them.

Mathematically, they clearly believe the commercial potential in these cases justifies the huge development costs and sizable risks, and feel that the potential exceeds that of the multiple other programs they could theoretically be resourcing instead (unless you have an even more cynical view, and believe they are pushing these huge programs because they have so little else worthwhile to fund).

I am struck by the difficulty of prediction, as I’ve discussed both recently, and also several years ago (with Nassim Taleb) here. Advancing a small number of large, intricate programs also seems like a vivid example of the sort of dangerously excessive investment in the highly fragile that Taleb inveighs against.

It will be interesting to see how these giant bets turn out.